A Predetermined Overhead Rate Is Calculated Using Which Formula

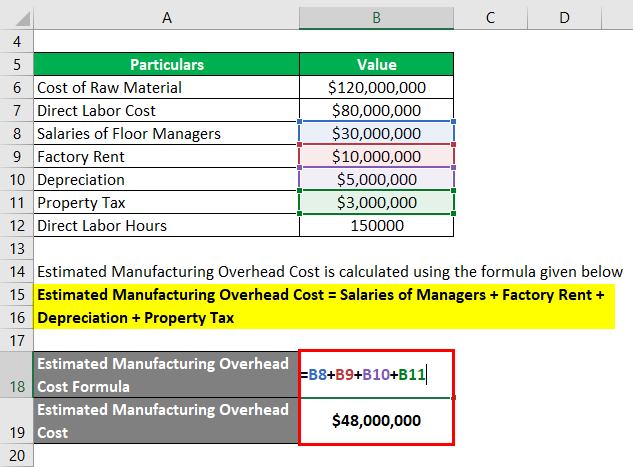

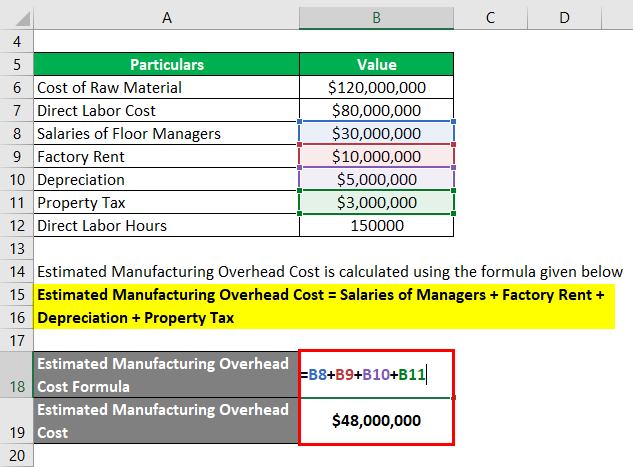

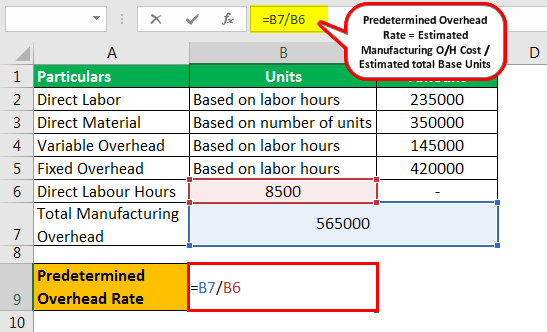

Predetermined Overhead Rate is calculated using the formula given below Predetermined Overhead Rate Estimated Manufacturing Overhead Cost Estimated Units of the Allocation Base for the Period Predetermined Overhead Rate 48000000 150000 hours. The predetermined overhead rate for machine hours is calculated by dividing the estimated manufacturing overhead cost total by the estimated number of machine hours.

Predetermined Overhead Rate Formula Calculator With Excel Template

What Is The Formula For Predetermined Overhead Rate.

. For the definition of overhead rate a manufacturing overhead cost is divided by the cost of the activity as a wholeUsing the following methods you can calculate a predetermined overhead rate by dividing overhead costs by the number of machines. The predetermined overhead rate formula is calculated by dividing the estimated manufacturing overhead cost by the allocation base. A predetermined overhead rate is calculated using which formula.

The sum would be. Based on this information the predetermined overhead rate is 25 per labor hour. Estimated manufacturing overhead cost Allocation base.

Predetermined Overhead Rate Formula Direct Labor. Actual manufacturing overhead costestimated units in the allocation base. Overhead costs are overapplied if the amount applied to Work in Process is greater than actual overhead incurred.

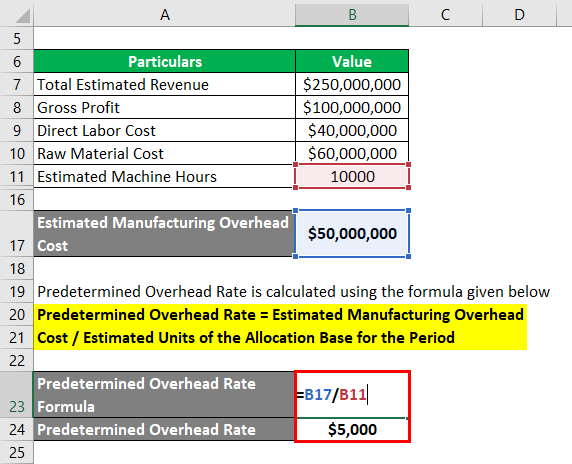

Predetermined Overhead Rate formula 5000010000 hours 5Labor hr. Indirect Costs Allocation Measure Predetermined Overhead Rate Note. 200 150 Posted By.

The estimated total activity base would be the direct labor hours in this case 10000. The estimated total manufacturing overhead costs would consist of variable and fixed overhead. The predetermined overhead rate is determined by dividing the pre-calculated manufacturing overhead cost by the activity driver.

As an example if you spend 10000 but produce only 2500 units you rinate rate formula if expenses come to 10000 for instance and you produce 2500 units 10000 divided by 2500 equals four. The predetermined overhead rate is generally expressed in currency values but can be converted to a percentage value by multiplying by 100. We identified it from well-behaved source.

With the manufacturing overhead costs and the machine hour totals you can calculate the predetermined overhead rate by dividing the overhead costs by the machine hours. Predetermined overhead is an estimated rate used by the business to absorb overheads in the product cost and its calculated by dividing overheads by the budgeted level of activity. 150000 400000 550000.

Indirect Costs Allocation Measure Predetermined Overhead Rate Note. We agree to this nice of Predetermined Overhead Rate. Therefore the predetermined overhead rate can be calculated by the sum 55000010000 giving a rate of 55.

Predetermined overhead rate Estimated manufacturing overhead costEstimated total units in the allocation base Predetermined overhead rate 80001000 hours 800 per direct labor hour. The formula for calculating Predetermined Overhead Rate is represented as follows Predetermined Overhead Rate Estimated Manufacturing OH Cost Estimated total Base Units You are free to use this image on your website templates etc Please provide us with an attribution link Where OH is overhead. Predetermined overhead rate 40000020000 2000.

Predetermined overhead rate 500000 20000 hours 25 per direct labor The product requires 2 hours of labor work so that it will require 50 of overhead 25 2 hours. A predetermined overhead rate is calculated using which formula. Its submitted by paperwork in the best field.

These are found out using assumptions and are not accurate. Here are a number of highest rated Predetermined Overhead Rate Formula Direct Labor pictures upon internet. Notice that the formula of predetermined overhead rate is entirely based on estimates.

06112016 0603 PM Tutorial 00311597 Puchased By. Predetermined Overhead Rate Total Estimated Overheads Total Labor Hours 200000 8000 hours 25 per hour Therefore the total cost of the job using labor hours as an appropriate basis will be calculated as follows. When an operating budget is applied to a cost object for a particular reporting period it.

For instance if the manufacturer estimates 10000 in overhead costs with 20000 machine hours the predetermined overhead rate is 50 cents per unit. Applied manufacturing overhead 2000 x 21000 420000 which is credited to Manufacturing Overhead. Using the formula you divide the total overhead cost 553000 by the activity base 316000 we get an allocation rate of 175 175.

Estimated units in the allocation baseestimated manufacturing overhead cost. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated budgeted overhead costs for the year divided by the estimated budgeted level of activity for the year. Examples of Predetermined Overhead Rate Example 1.

This activity base is often direct labor hours direct labor costs or machine hours. In this case these numbers are not estimated because. Follow the short instruction to calculate overhead costs.

Calculating predetermined overhead rate can be done as follow. The adjusted overhead is known as over or under-recovery of overhead. The predetermined overhead rate can be calculated by using the following formula.

Both figures are estimated and need to be estimated at the start of the projectperiod. A price is calculated per unit using this formula. Estimated manufacturing overhead costestimated units in the.

Whether youre a small business owner or part of a large procurement and financial analysis. Estimated manufacturing overhead costactual units in the allocation base. As is apparent from both calculations using different basis will give different results.

The predetermined overhead rate is generally expressed in currency values but can be converted to a percentage value by multiplying by 100. When the activity driver is machine-hours then the accountant should divide overhead costs by the calculated number of machine-hours. Predetermined Overhead Rate Estimated Cost of Manufacturing Overhead Estimated Activity Driver Now lets take a look at this formula in action with some examples.

This formula refers to the predetermined overhead because this overhead total is based on estimations rather than the actual cost. The differences which arise between the actual overhead and the estimated predetermined overhead are set and adjusted at every year-end. Whether youre a small business owner or part of a large procurement and financial analysis.

A predetermined overhead rate is calculated using which formula Available for. Actual manufacturing overhead costestimated units in the allocation base Estimated units in the allocation baseestimated manufacturing overhead cost Estimated manufacturing overhead costactual units in the allocation base Estimated manufacturing overhead cost.

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

No comments for "A Predetermined Overhead Rate Is Calculated Using Which Formula"

Post a Comment